change in net working capital dcf

We do this in three key ways. On the other hand if the company is unable to produce positive working capital then the company has to take its excess liabilities such as higher short-term borrowings higher accounts payable etc.

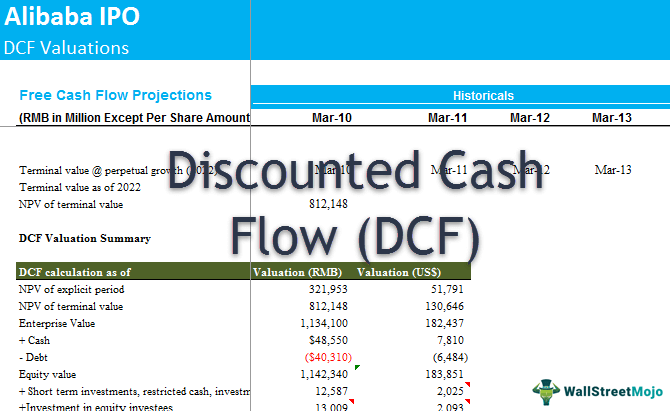

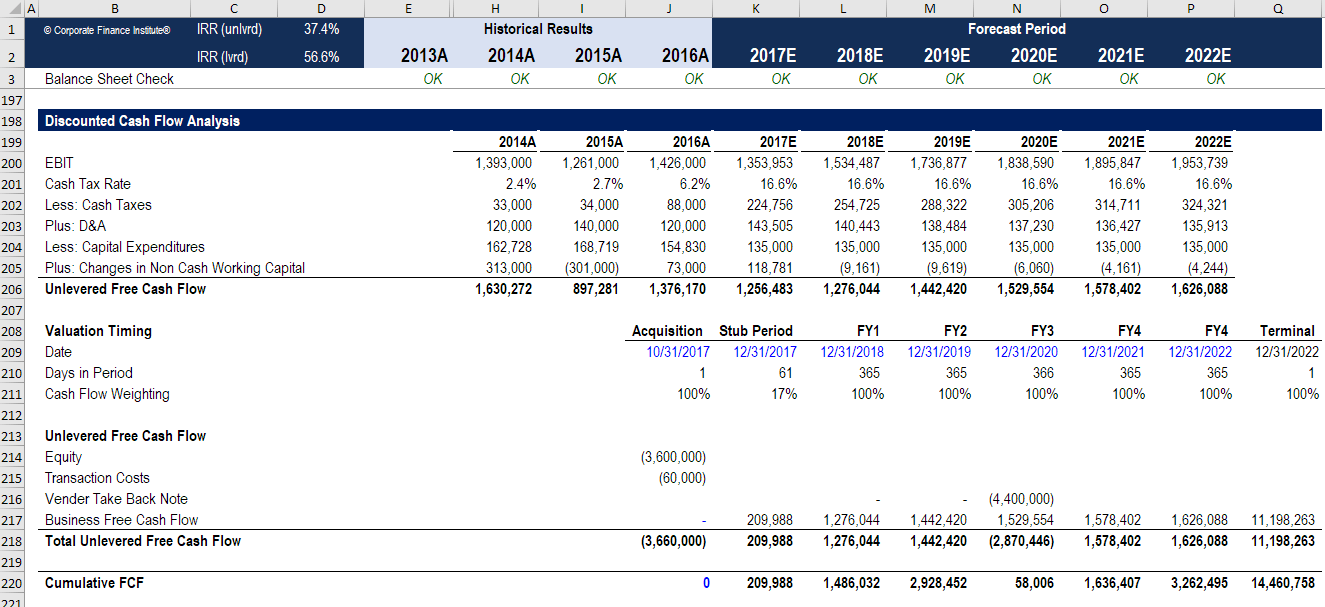

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

The main difference between the FCFF and FCFE is the impact of interest expenses and their tax.

. Invested Capital Fixed Assets Net Working Capital NWC. At the Delaware Community Foundation our focus is on building opportunity and advancing equity. Another striking formula of each analyst inspect is the operating.

ΔWorking Capital Net change in the Working Capital. Net Present Value 36m Discounted Cash Flow Internal Rate of Return 19m Discounted Cash Flow Annuities and Perpetuities 23m Accounting Rate of Return 14m Chapter 8. Investments are essentially current capital expenditures incurred at present in anticipation of future returns.

T Tax rate. In contrast in Scenario B the NOPAT increased 5m too but 150m was spent so focusing on the growth in NOPAT by itself would be misleading in the latter case. These teams operate in a rapidly moving environment and work closely with an advisory partner.

Working capital also known as net working capital ebbs and flows from company to company some companies are more seasonal. Meaning of DCF Techniques. Let us take the example of Apple Inc.

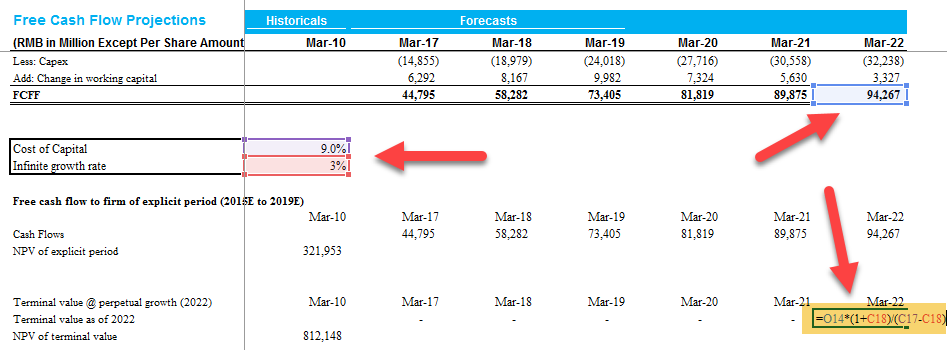

As that approaches their needs for working capital will grow. In this environment its fair to ask if the discounted cash flow DCF. Net changes in working capital are adjusted in the free cash flow projections to arrive at the free cash flow figure.

Helping Donors We partner. Relevant Cash Flows for DCF Relevant Costs example 1 29m Relevant cash flows for DCF Working. Debt Capital Markets DCM groups are responsible for providing advice directly to corporate issuers on the raising of debt for acquisitions refinancing of existing debt or restructuring of existing debt.

Since 2 October 2019 the current EONIA methodology has been. Notice that FCFE and FCFF share very similar terms such as depreciation capital expenditures and changes in working capital. Positive net working capital is resultant when a company has enough current assets over its current dues.

In any economy capital or funds invested have value and therefore time value of money is an important concept. Capital Expenditures Depreciation Amortization gets a bit more complicated especially if youre analyzing a company that follows IFRS see the next section. Working group on euro risk-free rates recommended STR for its replacement after a public consultation.

Okay now that we understand working capital lets look at non-cash working capital. When using an intrinsic valuation method such as the Discounted Cash Flow DCF. At the Delaware Community Foundation our focus is on supporting our community.

What is the transition from EONIA to STR uro Short- Term Rate 1 In order to maintain EONIA for a transitional period and until its discontinuation in 2022 its methodology will be changed. As per Apple Incs annual report for the year the companys net PPE stood at 3738 billion and 4130 billion as of September 28 2019 and September 29 2018 respectively. To calculate the computation of capital expenditure for a real-life company.

Similarly the change in operating assets and liabilities represents non-cash current assets and liabilities like accounts receivables and inventory and are treated in the same way as changes in working. Capital expenditure CapEx is a payment for goods or services recordedor capitalizedon the balance sheet instead of expensed on the income statement. Return on Invested Capital ROIC Excel Template.

Net Interest Expense Other Income Expense most. Management of Working Capital Introduction 30m Overcapitalisation and Overtrading 12m. The change in invested capital was 25m more for an increase of 5m in NOPAT.

Think of retail as we approach the holiday shopping season. You can ascertain the figure from the previous years balance sheet. We plan to return to the offices on a hybrid schedule soon.

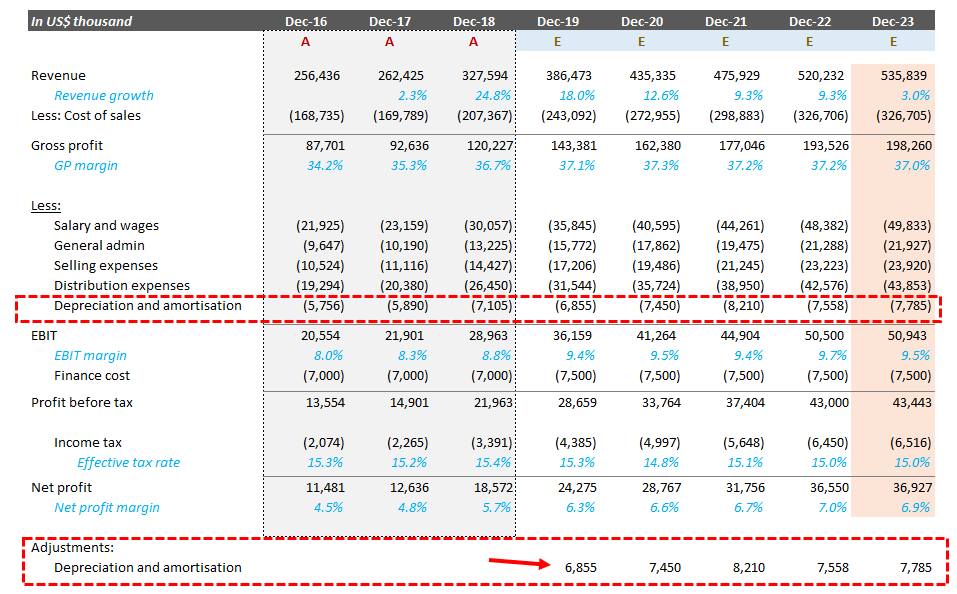

On the other hand the depreciation and. In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed in. The Change in Working Capital.

Hence the timing of expected future cash flows is important in the investment decision. This list means that you ignore almost everything else. DCF staff are working remotely because of the pandemic.

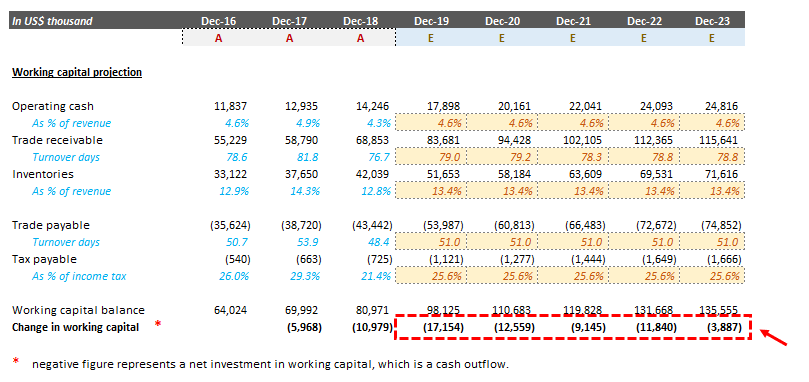

Change In Working Capital Video Tutorial W Excel Download

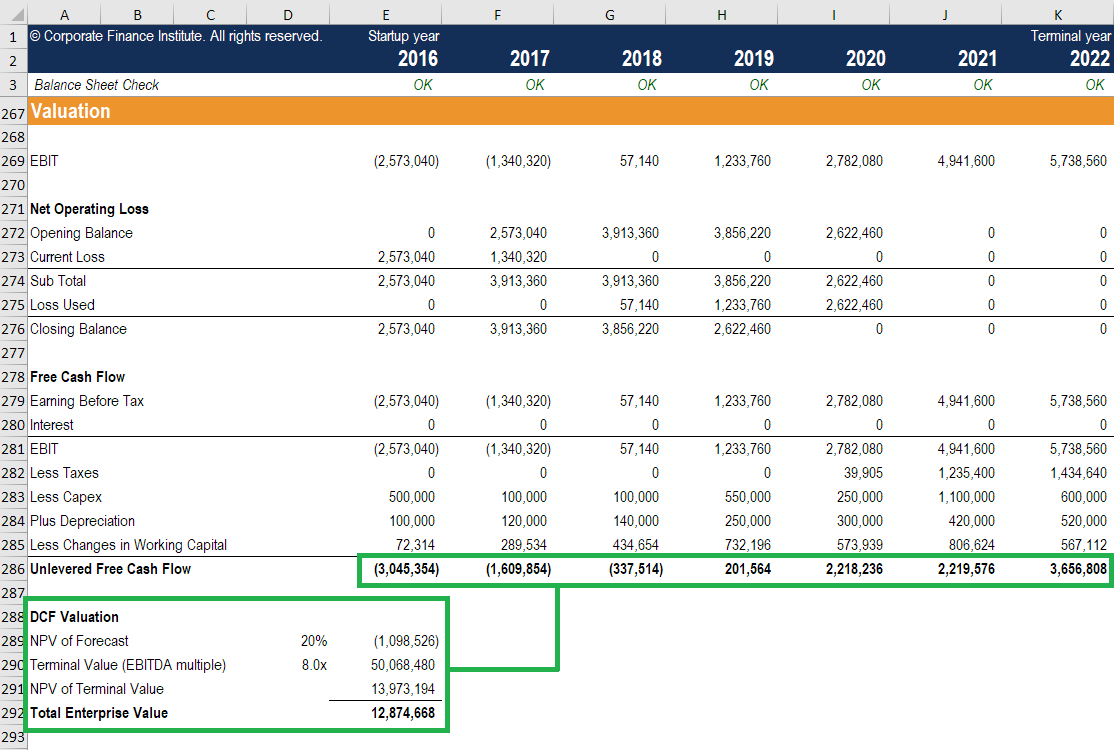

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Working Capital Video Tutorial W Excel Download

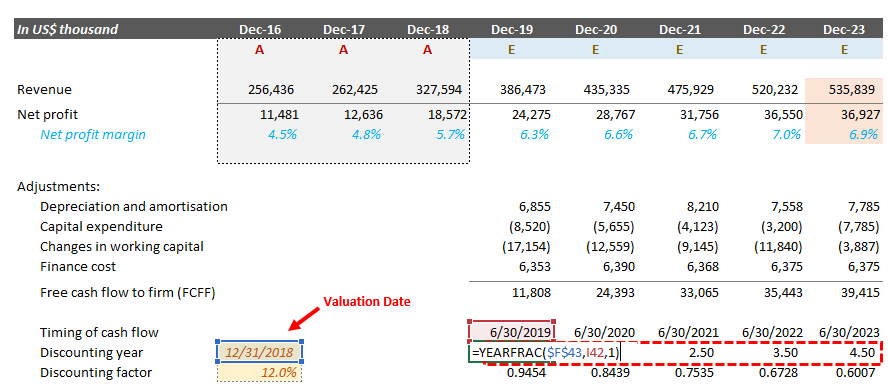

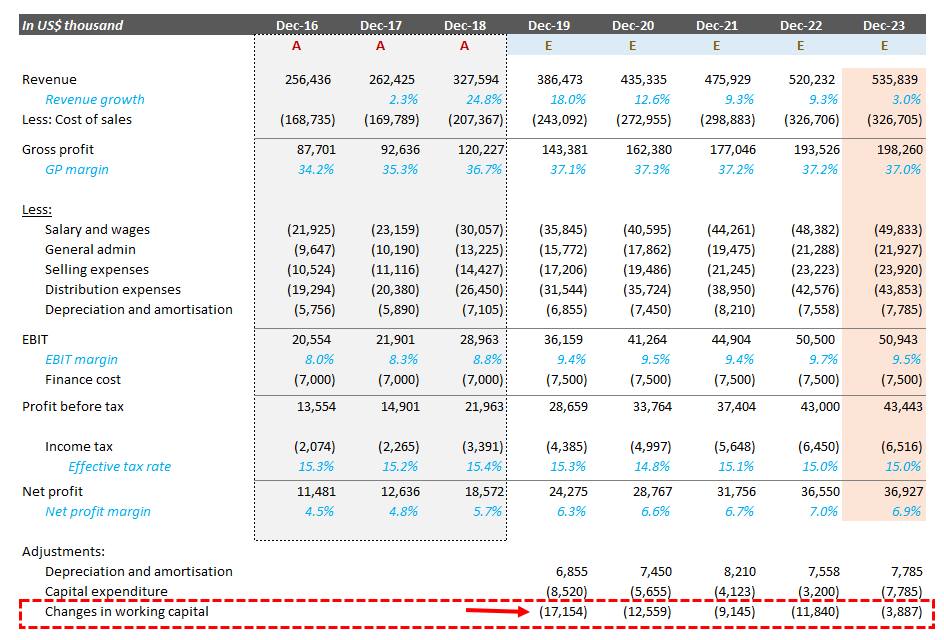

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Types Of Cash Flows Cash Flow Statement Cash Flow Investing

Change In Net Working Capital Nwc Formula Calculator

Hotel Valuation Financial Model Template Efinancialmodels Business Valuation Financial Modeling Revenue Management

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Working Capital Video Tutorial W Excel Download

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Dcf Analysis Pros Cons Most Important Tradeoffs In Dcf Models

Discounted Cash Flow Model Street Of Walls

Saas Financial Model Template Efinancialmodels Financial Dashboard Financial Modeling Saas

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance